The tech company is now second only to Apple, which has a valuation of $3.4 billion.

At the time of writing, Nvidia is trading at $132. The Silicon Valley firm is now recording its largest market cap since August, and its $3.19 trillion market value has overtaken Microsoft ( $3.07 trillion ) to become the world’s second-largest company for the first time in six weeks; Nvidia is now behind only Apple, which has a valuation of $3.4 trillion .

Nvidia’s strong start to the week came despite losses in the broader market, with the S&P 500 falling 0.6% as higher bond yields and oil prices weighed on equity momentum.

Shares of five other trillion-dollar tech companies besides Nvidia fell Monday:

- Apple fell 1.3%

- Microsoft 0.7%

- Alphabet (Google parent) 1.4%

- Amazon 2.8%

- Meta (Facebook matrix) 0.9%

Why did Nvidia shares rise?

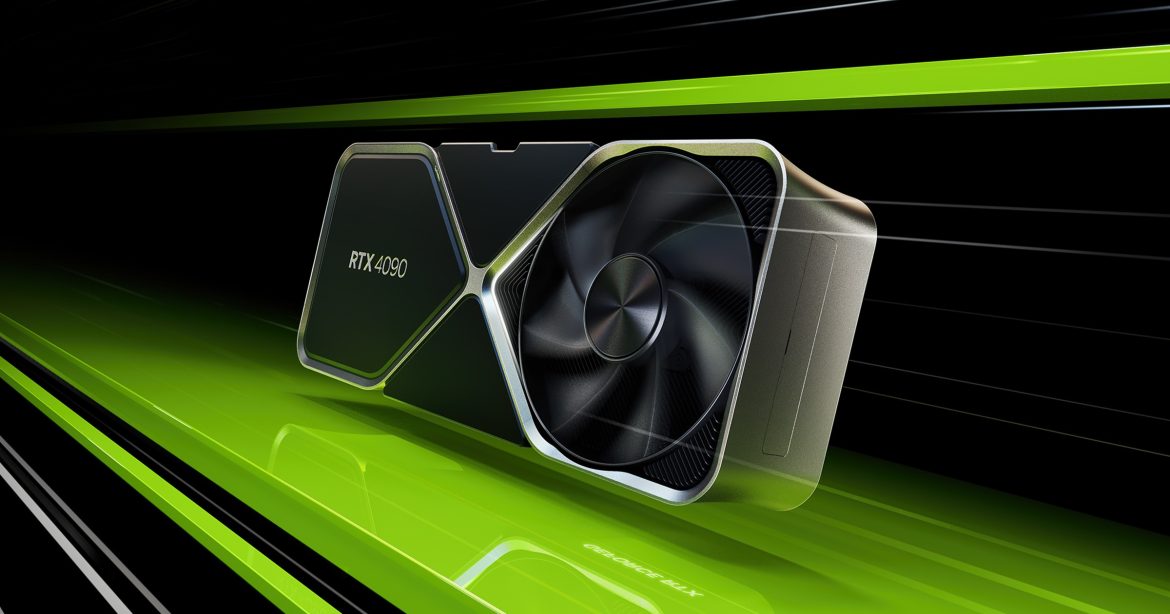

Nvidia, which designs a full range of custom AI technology for high-end applications such as large-scale language models, benefited Monday from an announcement by Super Micro Computer , another AI technology maker , that it reported strong sales of its liquid-cooled products deployed alongside Nvidia’s graphics processing units (GPUs) this quarter.

Another upbeat note from an analyst also boosted the stock, as Melius Research’s Ben Reitzes wrote to clients that the «outlook remains quite favorable» for Nvidia stock, even as it enjoys an extended rebound.

$21.9 billion. That’s how much adjusted profit Nvidia is expected to report in its fiscal quarter ending this month, according to the average analyst forecast compiled by FactSet. This represents a more than 80% increase in earnings before interest, taxes, depreciation and amortization (EBITDA) year over year and a jump of more than 1,000% compared with the comparable period in 2022.

According to Reitzes, “heavy spending on AI” by companies like Microsoft, Alphabet and OpenAI (parent company of ChatGPT) should “catalyze uptake” of GPUs, Nvidia’s core product. The optimism about demand follows continued comments from Nvidia’s billionaire CEO Jensen Huang, who insists that demand for its AI products is “so huge” and “crazy.”

This week is merely the continuation of a period of outstanding returns for Nvidia, as its 26% return since Sept. 6 far outpaces the S&P 500’s 6% gain over that period and the 7% average gain of its five trillion-dollar tech peers.

Nvidia was briefly the world’s largest company in June, when its share price hit an all-time high of $140.76 . Previously a low-profile company known for its video game business, Nvidia became a Wall Street darling as its profits soared amid the rise of generative artificial intelligence. Nvidia’s valuation has increased tenfold over the past two years .