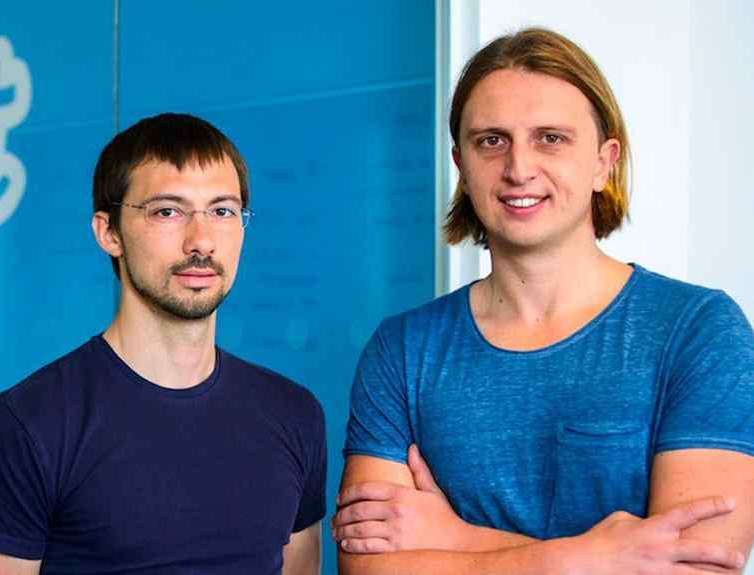

Revolut co-founders Nik Storonsky and Vlad Yatsenko took to the stage in London this afternoon to celebrate their near-decade-long mission to reach 50 million customers around the world, with the fintech’s plain-spoken CEO giving his take on the milestone.

«It seems like a lot, but it’s still not enough. There are so many people in the world,» Storonsky said.

Revolut’s leadership team clearly has even loftier ambitions in mind. The fintech says it aims to build the world’s first truly global bank. Its aggressive expansion plans include doubling its customer base to 100 million and generating annual revenues of $100 billion . And that’s not all.

Revolut also aims to dominate the rankings for downloaded financial apps . “We want to be not only number one in Europe in every country, but also in the US, Canada, Latin America and Asia. That’s the goal,” Storonsky said.

The London-based fintech can afford to be ambitious after securing a $45 billion valuation in an employee share sale last August and receiving a UK banking license in July, which should pave the way for further regulatory approvals in the US and other markets. Revolut already has an EU banking license.

Founded in 2015, Revolut operates a bank-like app that customers can use to deposit funds, make payments and trade currencies, stocks and cryptocurrencies. Revolut says 2025 will be “bigger and better” as it launches a number of new products and services.

The fintech said its plans for next year include the launch of a new AI-powered assistant that is designed to adapt to customers’ needs and preferences and then guide them toward smarter financial habits.

Revolut is also planning to launch its mortgage product in Lithuania , followed by Ireland and France . It will also begin rolling out branded ATMs that dispense cash and cards in Spain early next year .