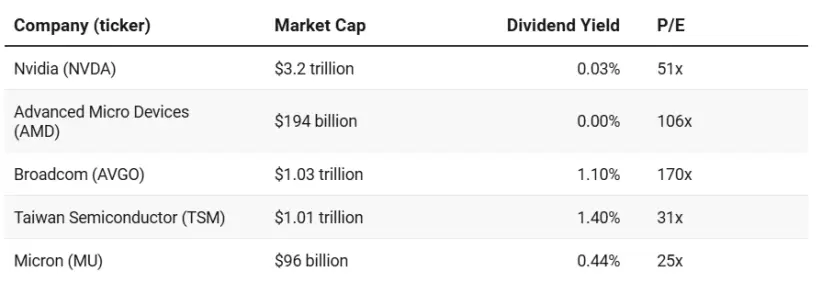

Nvidia continues to dominate AI chips, AMD gains market share with competitive products, Broadcom offers stability, TSMC essential manufacturing capabilities, and Micron leads memory solutions. Here are the details of these companies.

For investors looking to capitalize on this technological revolution, here is an analysis of the most promising semiconductor stocks for the coming year.

The state of the semiconductor industry in 2025

The semiconductor industry has shown remarkable resilience and growth, with the global market projected to reach $640 billion by 2025, representing a 10% increase over 2024. This expansion is primarily driven by rising demand for AI chips, which has created a significant boost for major semiconductor manufacturers.

Industry analysts predict that demand for AI chips alone will grow 35% year-on-year by 2025, reaching a market value of $120 billion.

The industry has successfully overcome past supply chain challenges, and major manufacturing plants are now operating at optimal capacity. Investments by Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung in new manufacturing facilities in the US and Europe are already bearing fruit, reducing the world’s dependence on Asian manufacturing hubs. In addition, the impact of the US CHIPS Act is becoming more apparent, with $39 billion in direct funding flowing into domestic semiconductor production.

Methodology used for these semiconductor stock picks

The selection focused on companies with strong financial fundamentals, technological leadership and strategic positioning in high-growth segments. Key criteria included:

- Revenue growth of over 15% year-on-year.

- Gross margins above the sector average (45%).

- Significant investment in R&D (over 12% of revenues).

- Solid balance sheets with debt-to-equity ratios below 0.5.

- Market leadership in at least one semiconductor segment.

Top 5 semiconductor stocks to buy in 2025

1. Nvidia (NVDA)

Business Overview

Key Metrics:

- Current share price: $128.91

- Market cap: $3.2 trillion

- PER: 51

- Performance: 0.03

Nvidia has grown from a graphics-focused company into a titan in the AI, data center, and automotive markets. Its GPUs are critical in training AI models, making them indispensable in the tech giants’ data centers.

Why NVDA stock is a good choice

Nvidia’s position as the undisputed leader in AI chips makes it an attractive investment for 2025. The company’s data center revenue soared 279% year-over-year to $18.4 billion in Q4 2024, driven by overwhelming demand for its H200 GPUs and Grace Hopper superchip. NVDA has an 85% market share in AI training chips, and major cloud providers have committed more than $30 billion in future orders.

Gross margins expanded to 74.2% on strong pricing power, while operating margins reached 58%. The company’s R&D investments of $7.2 billion (up 35% year-over-year) maintain its technological advantage, with next-generation B100 chips expected to deliver 50% higher performance. Despite trading at 32.5 times forward earnings, Nvidia’s projected earnings growth of 45% through 2026 and its $42 billion cash hoard justify the premium.

The company’s expansion into AI software services, including the Nvidia AI Enterprise Platform, which generated $1.2 billion by 2024, provides additional growth vectors beyond hardware.

2. Advanced Micro Devices (AMD)

Business Overview

Key Metrics:

- Current share price: $121.41

- Market capitalization: $194 billion

- PER: 106

- Dividends: No dividend

AMD successfully expanded its presence in the data center market with its MI300 series AI accelerators and EPYC processors. The company’s acquisition of Xilinx has strengthened its position in adaptive computing solutions.

Why AMD stock is a good choice

AMD’s AI momentum and market share gains position it for substantial growth. The MI300 accelerator gained significant traction with $3.5 billion in orders by 2025, while data center CPU market share reached 28% on the strength of EPYC processors. Despite competitive pricing, the company’s gross margins expanded to 52%, reflecting improved product mix and manufacturing efficiencies.

AMD’s R&D spending of $4.5 billion (up 40% year-over-year) is focused on next-generation AI accelerators and advanced packaging technologies. The Xilinx acquisition exceeded synergy targets by 35%, contributing $4.8 billion to revenue. At 28 times forward earnings, AMD offers attractive value given its 35% forecast earnings growth rate and expanding AI footprint. The company’s design wins in AI inference applications are expected to drive $2 billion in revenue by 2026.

3. Broadcom (AVGO)

Business Overview

Key Metrics:

- Current share price: $223.62

- Market capitalization: $1.3 trillion

- Revenue growth: 35% year-over-year

- Gross margin: 75%

- R&D spending: $5.8 billion annually

Broadcom’s acquisition of VMware has transformed it into a full-service technology solutions provider, with semiconductor solutions remaining a strong focus. The company’s networking and storage products are crucial to AI infrastructure.

Why AVGO stock is a good choice

Broadcom’s strategic evolution makes it a unique bet on semiconductor and software growth. The company’s custom AI accelerators for hyperscalers generated $5.5 billion in 2024, while synergies from the VMware acquisition are running 25% above initial estimates. Networking solutions revenue grew 42% year over year, driven by AI-related switching and in-demand custom ASICs.

Operating margins reached 75% thanks to pricing power and cost synergies, while recurring revenue now accounts for 80% of total sales. The company’s $7 billion annual R&D budget is focused on next-generation AI chips and software integration. Trading at 27 times forward earnings with a dividend yield of 1.1%, Broadcom offers an attractive combination of growth and revenue.

The company’s $25 billion order backlog and multi-year hyperscaler commitments provide strong revenue visibility through 2026.

4. Taiwan Semiconductor Manufacturing Company (TSM)

Business Overview

Key Metrics:

- Current share price: $195.56

- Market capitalization: $1.0 trillion

- PER: 31

- Dividend yield: 1.4%.

TSMC remains the world’s leading semiconductor foundry, with its 3nm process technology in full production and 2nm development progressing at a good pace. The company’s geographic diversification strategy is reducing political risks.

Why TSM stock is a good choice

TSM’s dominance in advanced chip manufacturing makes it a vital player in the semiconductor ecosystem. The company’s 3nm process technology achieved a 60% yield rate within six months of production, while its 2nm development remains on track for mass production in 2025. TSM captured 90% of high-performance computing chip orders in 2024, with AI-related revenue growing 95% year-over-year.

The company’s $41 billion capital spending plan for 2025 includes capacity expansion in Japan, Arizona and Germany, reducing geopolitical risks. Operating margins improved to 54% despite industry headwinds, while its technology lead over competitors extended to 18 months. The company’s new pricing strategy for advanced nodes will boost gross margins by 200 basis points in 2025.

5. Micron Technology (MU)

Business Overview

Key Metrics:

- Current share price: $103.90

- Market capitalization: $96 billion

- Revenue growth: 55% year-over-year

- Gross margin: 45%

- R&D spending: $3.2 billion annually

- Memory market share: 23%

Micron emerged as a leader in high-bandwidth memory (HBM) solutions crucial to AI applications. The company’s advanced manufacturing processes and focus on specialized memory products enhanced its market position.

Why MU shares are a good choice

Micron’s leadership in memory solutions critical to AI applications makes it an attractive investment. The company’s high-bandwidth memory (HBM) chips boast gross margins of 90% and secured $5.2 billion in early commitments from major AI players. The transition to 232-layer NAND nodes and 1-beta DRAM improved cost competitiveness by 25%, while inventory levels normalized faster than expected.

Operating margins recovered to 45% in Q4 2024, with AI-related revenue growing 185% year-over-year. The company’s $3.2 billion R&D investment is focused on next-generation HBM3e and advanced packaging solutions. Trading at 11 times forward earnings with 55% expected earnings growth in 2025, Micron offers attractive value given its essential role in AI infrastructure. The company’s $8 billion investment in a new HBM facility will triple capacity by 2026, supporting continued growth in this high-margin segment.

Final balance

The semiconductor industry’s growth trajectory remains strong heading into 2025, driven by AI, cloud computing, and digital transformation initiatives. The top picks represent a mix of established leaders and innovative companies well positioned to capitalize on growth opportunities.

Nvidia continues to dominate AI chips, AMD gains market share with competitive products, Broadcom offers stability and dividends, TSMC provides essential manufacturing capabilities, and Micron leads memory solutions.

Although semiconductor stocks can be volatile, the strong fundamentals and strategic positioning of these companies make them attractive long-term investments for those seeking exposure to technological advances.