MOBILIZING AI’S INFANTRY

Alexandr Wang’s Scale was conceived as a one-stop shop for supplying human labor to perform tasks that could not be done by algorithms – essentially, Scale was conceived as the antithesis of AI.

In 2018, on a trip to his ancestral homeland, Alexandr Wang listened as China’s brightest engineers gave impressive presentations on artificial intelligence. He found it odd that the researchers conspicuously avoided any mention of how AI might be used. Wang, whose immigrant parents were nuclear physicists at Los Alamos National Laboratory, where the first atomic bombs were designed, was unsettled.

“They were really dodgy on what the use cases were. You could tell it was for no good,” recalls Wang, the co-founder of Scale AI, who has no “e” in his first name so that it has eight characters, a number associated with good fortune in Chinese culture. Scale was then an up-and-coming start-up providing data services primarily to self-driving auto makers. But Wang began to worry that AI might soon upend a world order that, excepting the fall of the Soviet Union, has remained mostly stable since World War II. “If you think about the history of humanity, it’s mostly been punctuated by war except the last 80 or so years, which have been unusually peaceful,” Wang says from Scale’s sixth-floor headquarters in downtown San Francisco, as the occasional (partly) self-driving car zips by below. “A lot of that has been because of American leadership in the world.”

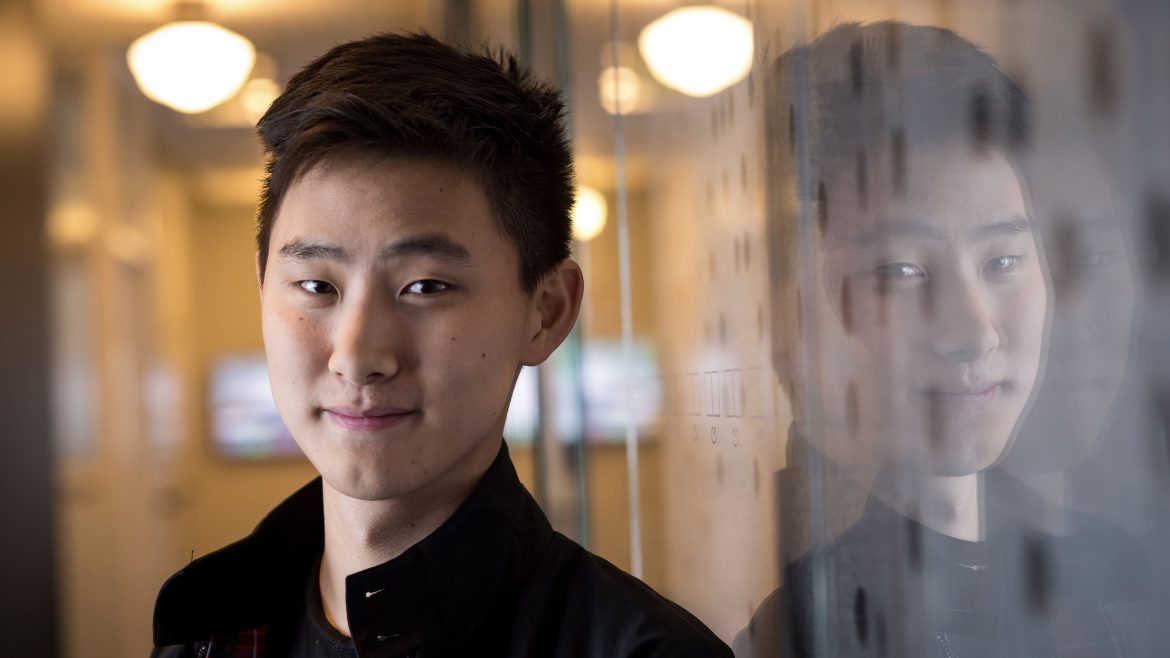

At first glance, Wang, 26, exudes the skittish energy of a fresh college graduate. He listens to “sad girl” musicians like Gracie Abrams and Billie Eilish and dresses “gorpcore,” an in-vogue style of fashionable hiking clothes. He posts Instagram photos with actor Kiernan Shipka of “Mad Men” fame and spouts pithy nuggets on Twitter: “The best problems can only be solved by blood, sweat, tears, spirit and an overwhelming sense of purpose,” he wrote in one February tweet. At bars, he still gets carded regularly.

None of that matters in Silicon Valley and D.C., where he’s already a power player. His rise began with a bet he made in 2016 to “label” the mass of data required to power AI, primarily for self-driving cars. Someone needed to train the AI to know the difference between a paper bag and a pedestrian. He cornered that market and put Scale in a good position in another sector: generative AI. It was a prescient move that helped him garner a client list that includes the biggest names in AI – and the U.S. government.

“We’re the picks and shovels in the generative AI gold rush,” Wang says. It has quickly become a lucrative business for Scale, which says it pulled in $250 million in revenue last year, at a time when many AI start-ups aren’t yet making a cent. Its tech has been used by the Defense Department to analyze satellite imagery in Ukraine and by Open AI to create Chat GPT, the bot that rocked the world with its ability to answer trivia and write poetry. Bret Taylor, former Co-CEO of cloud software giant Salesforce, likens Scale’s rise to that of cloud computing darlings Snowflake and Datadog. Former Amazon consumer boss Jeff Wilke, one of Wang’s most trusted advisors, takes an even more enthusiastic view: Scale could become the Amazon Web Services of AI.

Investors awarded Scale a $7.3 billion valuation in 2021, making Wang the latest Silicon Valley insta-billionaire. But his fortune wasn’t built entirely on silicon. It was also built with a vast outsourced workforce that performs a rudimentary task crucial to AI: labeling the data used to train it. Those people – some 240,000 of them in countries including Kenya, the Philippines and Venezuela – work for Remotasks, a subsidiary Scale doesn’t mention in public marketing materials. In other words, if AI does someday liberate humans from mundane workplace tasks, it will have done so using a legion of workers in the Global South, many of whom are paid less than $1 an hour. “They’re very, very important to the process of building powerful AI systems,” Wang says of his Remotasks workers.

They’re also, increasingly, an ethical concern, with worries emerging about substandard working conditions and low pay. Meanwhile, competitors see Scale as a house of cards that has suffered layoffs and declining value on secondary markets in the past year that has stripped Wang of billionaire status. (Those markets now value his 15 % stake at $630 million; Scale argues it’s worth closer to $890 million.) “Scale markets itself as a technology company,” says Manu Sharma, co-founder of rival start up Labelbox. “For us, they’re no different than any business-process outsourcing company.”

“I would say that we’ve been working on this problem longer and have built more technology than anyone else,” Wang counters. He’s trying to follow Amazon’s playbook of managing the entire chain, from warehouses to shipping. For Scale, that means both the machines – which are increasingly automating the data work – and the human army, which is growing ever larger. “We’re always going to want a human in the loop,” Wang says.

Before college, Wang moved to the Bay Area to work for internet start-up Quora, where CEO Adam D’Angelo gave him a crucial piece of advice: Four years of college is overrated, two is underrated. In the end, Wang spent just one year at MIT before heading to storied start-up accelerator Y Combinator. There he teamed up with Quora alum Lucy Guo, another dropout, to start Scale in 2016. He remembers being “ridiculously young” at the time, just 19. “But I was just like: ‘Yeah, I know how to code. We’re going to go do this thing!’”

As it was first conceived, Scale was to be a one-stop shop for supplying human labor to perform tasks that could not be done by algorithms – essentially, the antithesis of AI. Accel partner Dan Levine was early to see its potential, offering the pair a seed investment of $4.5 million (and his basement as temporary headquarters) in July 2016. Within months, Wang and Guo realized Scale was a viable solution to a problem plaguing the self-driving car companies at AI’s then-frontier: They had millions of miles of on-the-road driving footage with which to train their autonomous vehicle AI, and not nearly enough people to review and label it. Scale could fill that need.

In 2018, Wang and Guo were named to Forbes’ “30 Under 30” list in enterprise technology. Guo subsequently left the company “due to differences in product vision and road map,” she says. “I think Alex has done a great job continuing to run the company.” Guo otherwise declined to comment for this story, and Wang declined to speak about their split.

Investor Mike Volpi first heard Scale’s name during a 2018 board meeting for autonomous vehicle (AV) start-up Aurora. “Who?,” he remembers asking. Scale’s data labeling service had become crucial for Aurora, he learned, just as it had for Uber and for General Motors’ self-driving subsidiary, Cruise. Volpi persuaded his firm, Index Ventures, to lead an $18 million investment in Scale that August, when its revenue was still shy of $3 million.

The AV wager was becoming a cash cow. Scale’s client list now included major international auto manufacturers such as Toyota and Honda, as well as Silicon Valley behemoths like Google AV subsidiary Waymo according to a June 2019 fundraising pitch deck seen by Forbes. An account with Apple’s secretive self-driving unit alone was bringing in more than $10 million, the document said, putting annual revenue on track to surpass $40 million. (Scale declined to comment on the deck.) By that summer, annual revenue was on track to surpass $40 million.

When Peter Thiel’s Founders Fund made a $100 million investment that minted Scale as a Silicon Valley unicorn in August 2019, it kicked off a $580 million fundraising spree, the final round of which valued the company north of $7 billion. It had taken Wang, then 24, just five years to become the youngest self-made billionaire in the world.

“There’s two things I deeply believe,” Wang says. “One, AI is a huge force for good, and it needs to be applied as broadly as possible. Two, we need to make sure that America is in a leadership position.”

So far Scale has made $60.6 million from such contracts, according to a government database. The company touted a $249 million award in a press release last year – but read the fine print and Scale’s ceiling of potential payouts is capped at $15 million. The lion’s share of government spending on AI is still going to the likes of Northrop Grumman and Lockheed Martin, not Silicon Valley upstarts.

“Those companies, they’re really not that cutting-edge when it comes to understanding generative AI,” Wang says. For him, government partnership is a long game. But three engineering leaders who used Scale at prominent AI start-ups told Forbes confidentially that they have concerns about the quality of its human-made AI training data. One described a text-based generative AI model that was hampered by the labelers’ poor English. “Their data quality can be high, but also that’s not a given,” said another. Said a Scale spokesperson: “We stand behind our products and [their] results.”

In January, Scale slashed 20 % of its full-time staff. Wang cited “uncertainty” in market conditions. Shares of the company are currently trading on private secondary markets at a 42% discount to the last funding round in July 2021. But Scale’s stakeholders remain confident. “He didn’t get to where he is because he’s a boy genius – MIT pumps out a lot of teenage dropouts,” says William Hockey, the billionaire co-founder of fintech Plaid, who sits on Scale’s board. “Alexandr has an absolutely insane work ethic like nobody I’ve ever met.”