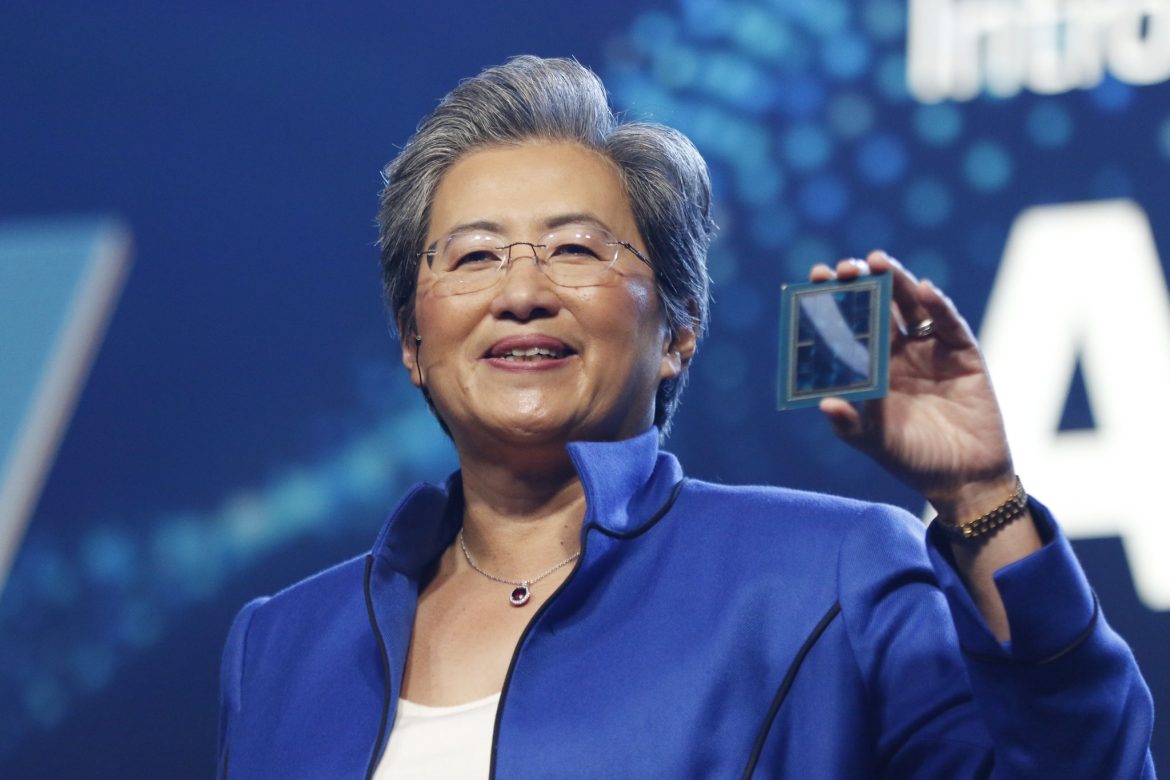

Lisa Su took over chipmaker AMD amid a share slump. Today, it has placed the company ahead of Intel in market value and has become a billionaire

Just two years after joining chipmaker Advanced Micro Devices in 2012, IBM veteran Lisa Su was tapped to take on the top role at age 43. It was a great promotion, but also a gamble. At the time, the company was in difficulty. It had laid off about a quarter of its staff and its stock price hovered around $2. Patrick Moorhead, a former AMD executive, remembers this as “the end of the line.”

His plan to fix AMD: create great products, deepen customer trust, and simplify the company . “Three things, just to simplify. Because if there are five or ten, it becomes more difficult.”

Su, who first fell in love with semiconductors while at the Massachusetts Institute of Technology, focused his engineers on building chips superior to Intel’s. It took time, but Su’s gamble ended up paying off. In less than a decade, she turned a struggling company into a chip industry darling now worth $271 billion.

First female CEO in the chip market

Now, the rally in tech stocks in 2024 has made Su the first female CEO of a major semiconductor company — and a new billionaire. She owns about 4 million shares – a small 0.2% share of the company – but these, along with the options granted to her, represent about three-quarters of her $1.1 billion fortune. The rest comes from the nearly $400 million in AMD shares it has sold since 2016, before taxes. When Forbes featured Su on the cover in May last year, she was worth $740 million. AMD shares have soared more than 75% since then (25% since the beginning of the year).

That makes Su, now 54, one of just 26 self-made US women billionaires, a group that includes entrepreneur Oprah Winfrey, Arista Networks CEO Jayshree Ullal and former Meta chief operating officer , Sheryl Sandberg. She is among 26 American CLT billionaires, those who made their money as executives, including Ullal and Sandberg.

Su immigrated from Tainan, Taiwan, to New York City when she was three years old, with her mathematician father and her mother, an accountant who became a businesswoman and opened an industrial supplies wholesaler. “I would say I’m a New Yorker at heart,” she declared. She chose to study electrical engineering at MIT because it seemed to be the most difficult major. And there she obtained three degrees in the field: bachelor’s degree, master’s degree and doctorate.

It was during his freshman year at MIT that Su began doing research in a semiconductor laboratory. “It was amazing for me and ever since then, semiconductors have been my passion,” she said in an interview.

Technology career

Before joining AMD as senior vice president and general manager of the company’s global business, Su worked at IBM for 13 years in various engineering roles – including as technical assistant to then-CEO Lou Gerstner – and then moved to Freescale Semiconductor in Austin, Texas. , assuming several leadership roles, including technology director. She still lives in Austin with her husband Daniel Lin, although AMD is headquartered in Santa Clara, California.

Su posited that success is tied to knowing where you excel. An experienced researcher, she focused on developing chips with the highest-performance processors on the market – those that could outperform their competitors on several criteria. Under Su’s guidance, AMD engineers spent three years of tinkering to create the super-fast Zen chip architecture, released in 2017.

Partnerships with NASA, Microsoft and Meta

By 2020, this chip design was the market leader in terms of speed, and new deals followed. Since then, AMD has partnered with NASA, Microsoft, Meta, Lenovo, Oracle, and Dell Technologies , transforming a stock that hovered below $3 (when she became CEO) to a recent $177 per share. Amid the stock surge, AMD’s market capitalization (though not its revenue) surpassed that of its longtime rival, Intel.

Last February, when AMD’s market capitalization surpassed Intel’s for the first time, AMD co-founder Jerry Sanders was ecstatic. “I called everyone I know!” he said. “I was delirious. My only regret is that Andy Grove isn’t around so I could say ‘gotcha!’” (Grove, the legendary former CEO of Intel, died in 2016.) AMD has now eclipsed Intel’s market cap by $90 billion.

Nvidia remains first in chips

The much bigger competitor, however, is Nvidia – which has significantly higher revenues than AMD and a market value of US$1.6 trillion, more than five times that of AMD. “Being a very capable second in a two-horse race is a good place to be,” says TD Cowen analyst Matt Ramsay.

But accelerated growth has slowed it down a bit. Last week, AMD reported that revenue fell 4% to $22.7 billion in 2023, while net profit fell 35% from the previous year to $854 million. The reason: Sales of chips used for video games declined and were only partially offset by higher revenues from chips for data centers.

There are still many opportunities for growth, mainly thanks to the excitement around AI. In December, Su unveiled a new line of chips for use in generative AI. The company forecasts a $77 billion market for AI chips across the industry this year, growing 70% annually through 2027. Su hopes to take a slice of Nvidia’s dominant share of the AI semiconductor market using its new series of MI300 chips – including one aimed at generative AI, with Microsoft as its main customer, and another powering supercomputers like Hewlett Packard’s El Capitan.

As Su told Forbes in May: “If you look five years from now, you will see AI in every AMD product, and it will be the biggest driver of growth.”