AI chipmaker Nvidia has become the first company in history to reach a $4 trillion valuation , the latest milestone for the undisputed leader in the generative AI gold rush.

Key facts

- Nvidia shares rose as much as 2.8% on Wednesday morning, hitting a new all-time high of $164.42.

- The Silicon Valley giant thus saw its market capitalization rise to $4.01 trillion, becoming the first publicly traded company to reach a valuation of $4 trillion.

In numbers

Nearly +35,000%. That’s how much Nvidia’s stock price has risen over the past ten years, far outperforming the S&P 500, which (including reinvested dividends) has risen by about 260%. This means that a $1,000 investment in Nvidia in July 2015 would be worth $350,000 today.

Surprising fact

Nvidia is worth more than the entire UK Gross Domestic Product, which was $3.9 trillion in 2023.

Key context

Valued at just over $10 billion a decade ago, Nvidia’s growth has been nothing short of meteoric, crossing the $1 trillion mark in 2023, then crossing the $2 trillion and $3 trillion mark in 2024. Wall Street’s infatuation with the Santa Clara, California-based company has paralleled the rise of generative AI services like OpenAI’s ChatGPT chatbot, as Nvidia holds a dominant share in designing the hardware and software needed to run these expensive programs.

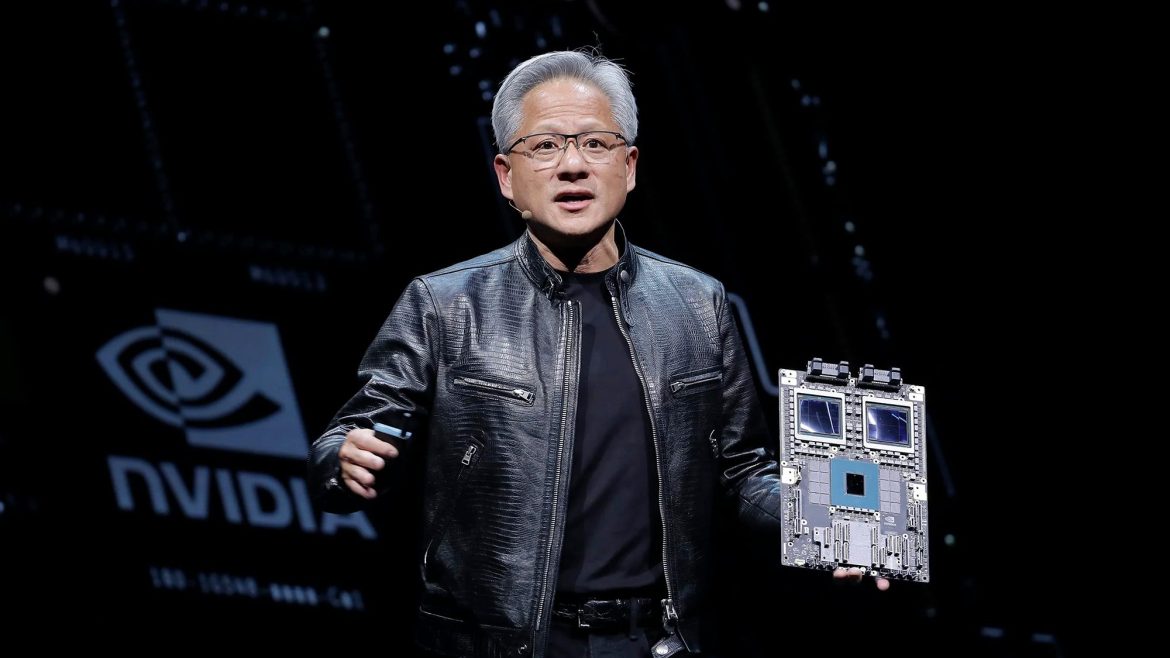

Nvidia’s flagship products are GPUs (graphics processing units), considered the gold standard for training advanced AI models. Nvidia’s major customers include OpenAI, Tesla and Elon Musk’s xAI, Meta, and Amazon.

Curiosity

The $4 trillion company has humble beginnings: It was born in 1993 during a meeting between co-founders Jensen Huang, Chris Malachowsky , and Curtis Priem at a Denny’s restaurant.

Forbes Rating

Jensen Huang , whose first job was as a dishwasher at Denny’s, is now the ninth richest person in the world with a net worth of $142 billion, according to our latest estimates . Nearly all of his fortune comes from his 3.5% stake in Nvidia.